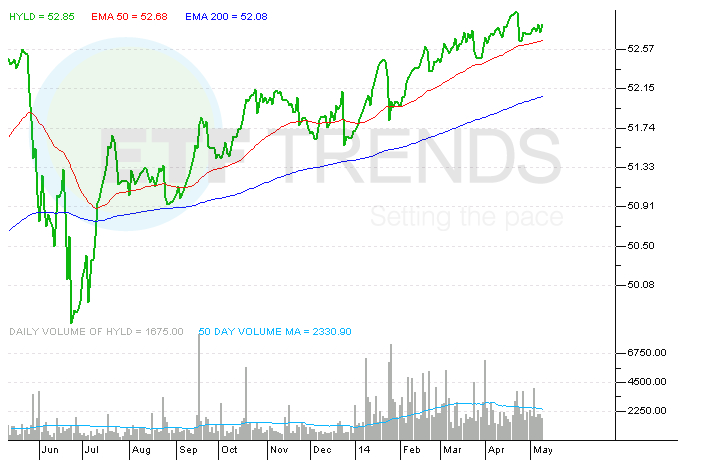

The AdvisorShares Peritus High Yield ETF (HYLD) is the newest entrant to the $1 billion exchange traded fund (ETF) club, cementing its status as one of the largest actively managed ETFs in the process.

HYLD is managed by California-based Peritus Asset Management, which specializes in unearthing opportunities in the high yield corporate and loan markets. Earlier this year, HYLD earned the prestigious five-star rating from Morningstar.

“We’ve seen increased interest from financial advisors, pension plans and family offices in the high yield market,” added Ron Heller, managing partner of Peritus, in a statement. “Historically low interest rates continue to hurt yield investors, and we feel that the market has come to understand that high yield bonds and leveraged loans are incredibly efficient in an active ETF structure. I’m tremendously proud of the team at Peritus and the great work they continue to do.”

HYLD currently sports a 30-day SEC yield of 7.93%.

******

AdvisorShares Peritus High Yield Fund is a component of the D2 Capital Management Multi-Asset Income Portfolio. The portfolio's current yield is 5.27% (as of 13 May 2014).Disclosure: I own the D2 Capital Management Multi-Asset Income Portfolio

The views expressed here are that of myself or the cited individual or firm and do not constitute a recommendation, solicitation, or offer by myself, D2 Capital Management, LLC or its affiliates to buy or sell any securities, futures, options or other financial instruments or provide any investment advice or service. D2, its clients, and its employees may or may not own any of the securities (or their derivatives) mentioned in this article.

The Jacksonville Business Journal has ranked D2 Capital Management in the top 25 of Certified Financial Planners in Jacksonville. The Firm is also a member of the Financial Planning Association of Northeast Florida, the Jacksonville Chamber of Commerce, the Southside Businessmen's Club, and the Beaches Business Association.

No comments:

Post a Comment